APPLYING AI AND BIG DATA IN INVESTMENTS: CHALLENGES AND OPPORTUNITIES

AI and Big Data Application in Investments: The New Frontier

In the words of numerous industry heavyweights, AI is the new electricity. The Economist magazine championed the slogan, “Data is the new oil.”(1).

We discuss in this section how some firms are taking advantage of frontier powers in investment management.

AI: NLP, Computer Vision, and Voice Recognition

Researchers have made tremendous strides in building the ultimate “seeing, hearing, and understanding” machine in recent years(2). In the case of natural language processing (NLP), computer vision, and voice recognition programs, AI is used to capture text, audio, and imagery from a variety of public sources and internal/vendor databases. Examples include transcribing analyst conference calls and extracting data from issuer filings for valuation models. In most cases, the program automates what is traditionally a manual and repetitive task performed by an analyst. We expect to see these types of applications being used more and more in the industry; they broaden the investment professionals’ reach and improve efficiency by combing through multiple data sources and combining them into one platform.

Such programs also increase human capacity by freeing time otherwise spent on manual work. Junior analysts used to spend much of their research time finding and entering information. These routine and repetitive activities will likely become the first to be taken over by AI programs, which have a natural advantage in this type of work.

AI: Machine Learning and Deep Learning

More sophisticated programs will further process the information harvested from various sources to generate signals to inform the investment decisionmaking process. This often requires sophisticated AI techniques, such as ML and DL.

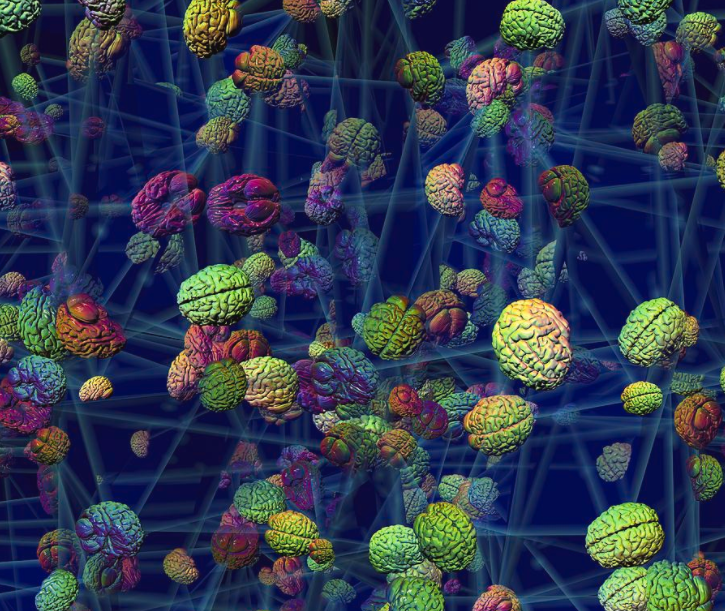

Machine learning is a general term for computing methods and algorithms that allow machines to uncover patterns without explicit programming instructions(3). ML programs inform themselves how to interpret inputs and predict outputs(4). Deep learning is a type of ML that is based on artificial neural networks (a type of learning modeled on the human brain).

DL algorithms are often applied to improve the results of NLP, computer vision, and voice recognition programs.

They can also help extract useful information from large piles of data. For example, these algorithms can infer certain key words from conference call transcripts or identify sentiment from unstructured data, such as social media. Such information can then be translated into trading signals or, more simply, alerts for human analysts and portfolio managers to process.

ML and DL programs are also popular with quantitative (systematic) managers who often find it helpful to apply these techniques in order to improve the effectiveness of their quantitative processes. There are several cases in the report that illustrate this point.

Traditional statistics and econometrics are based on techniques first developed a couple of centuries ago, and their applications in finance often involve linear regression models. These linear models are effective in many situations. However, at least some of the complexities in the real world may be better captured using ML techniques because of their ability to handle contextual and nonlinear relationships, which can often arise in finance. For example, ML techniques may be more effective than linear regressions in the presence of multicollinearity (where explanatory variables are correlated)(5). In these cases, ML and DL techniques provide investment managers with additional toolkits that can give them an edge(6).

(1). See www.economist.com/leaders/2017/05/06/the-worlds-most-valuable-resource-is-no-longer-oil-but-data.

(2). See Larry Cao, “Artificial Intelligence, Machine Learning, and Deep Learning: A Primer,” Enterprising Investor blog (13 February 2018):

primer/.

(3). K.C. Rasekhschaffe and R.C. Jones, “Machine Learning for Stock Selection,” Financial Analysts Journal, vol. 75, no. 3 (Third Quarter 2019).

(4). Cao, “Artificial Intelligence, Machine Learning, and Deep Learning” (2018).

(5). See Rasekhschaffe and Jones (2019).

(6). For suggested further reading on machine learning, including types of ML algorithms and their applications, see the CFA Institute

Refresher Reading on “Machine Learning” (2020 Curriculum), available to CFA Institute members and charterholders